Post

Why the Aqaba | Petra | Wadi Rum Triangle Can Redefine MICE in the Middle East

The global MICE market (meetings, incentives, conferences, exhibitions) is no longer a side business for tourism. It is a core driver of trade, corporate growth, and city positioning. Recent market studies estimate the global MICE industry at around 1.2 trillion USD in 2024, with forecasts that it will more than double by the early 2030s. Grand View Research+1 .

Jordan offers a different model. The Aqaba | Petra | Wadi Rum triangle has the potential to become a connected MICE corridor where exhibitions, corporate retreats, incentives, gala dinners, concerts, and festivals operate under a single strategic narrative.

From venues to experience corridors

Corporate clients and organizers are shifting away from single-venue thinking. The new demand is for complete experience corridors that combine:

- A serious base for business content and trade.

- High quality networking environments.

- Strong emotional and cultural settings that support relationship building and brand positioning.

Traditional convention cities can deliver the first two elements. Very few destinations can deliver all three within one country, under one visa regime, and within a compact geography.

This is the competitive advantage of Jordan. Aqaba acts as a coastal HQ city. Petra and Wadi Rum offer heritage and desert environments that are globally recognized, visually stunning, and ideal for carefully designed corporate programs. Aqaba Special Economic Zone Authority+2Ammon News+2.

Jordan and Aqaba in the regional trade and tourism context

Tourism is a central pillar of Jordan’s economy. According to the Central Bank of Jordan, tourism revenues reached about 7.24 billion USD in 2024. بترا -وكالة الأنباء الأردنية+1 The Ministry of Tourism and Antiquities has positioned tourism growth as a key part of the national economic vision and is preparing a new National Tourism Strategy for 2025–2028 following the 2021 – 2025 strategy, which explicitly highlights MICE tourism as a high-value niche product. jsf.org+3mota.gov.jo+3بترا -وكالة الأنباء الأردنية+3

Aqaba’s role is different from a typical resort town. The Aqaba Special Economic Zone was created as a model hub for investment, trade, tourism, and logistics services, managed by an autonomous authority (ASEZA). Aqaba Special Economic Zone Authority+3jsf.org+3Wikipedia+3.

Key elements include:

- Strategic position at the northern tip of the Red Sea, connecting Asia, Africa, and Europe.

- A legal and regulatory framework designed to attract international investment, trade, and high value tourism.

- Development of logistics and port infrastructure that supports regional trade flows. CBJ+2adc.jo+2

- Aqaba already hosts high profile events such as SOFEX Jordan, a major defence and special operations exhibition held at the Aqaba International Exhibition and Convention Centre, with wide local and international participation. Armada International+3Jordanian Armed Forces+3adc.jo+3

- In parallel, Jordan’s heritage and cultural landscape has hosted multi-day festivals and concerts in Petra, Wadi Rum, Amman, and Aqaba, such as Medaina, which combined music, art, and local culture across these sites and attracted international coverage. 7HillsJo+3Wallpaper*+3Rolling Stone India+3

- Gap Note: The pieces already exist. The opportunity is to connect them into a coherent MICE platform.

Aqaba as HQ for exhibitions, FMCG trade, fintech summits, and booth productions.

Aqaba functions naturally as an HQ city for:

- FMCG exhibitions that target buyers from the Levant, the Gulf, and North Africa, with direct linkage to port, logistics, and industrial facilities.

- Fintech summits focused on payments, digital infrastructure, and regulatory sandboxes with regional participation.

- Trade fairs across logistics, energy, renewables, defence, and technology.

- Concerts and festivals in the Middle East that need waterfront stages, hotels, and transport connections.

- From a production perspective, Aqaba can host:

- Plenary sessions and multi-track conferences.

- High quality booth productions for global brands.

- Hybrid broadcast and content studios for live and on-demand viewing.

- The difference, compared to more crowded MICE cities, is that Aqaba can be positioned as the operational base of a larger experience corridor that includes Petra and Wadi Rum, without requiring internal flights or complex cross-border logistics.

The Golden Pass concept for public exhibitions

In a typical exhibition, a visitor spends three or four days inside halls, attends one or two sponsored receptions, and leaves with a badge and a stack of brochures.

A Golden Pass concept restructures that journey. The idea is simple: if a major exhibition is based in Aqaba, the pass itself can integrate Petra and Wadi Rum within the same commercial product.

In a typical exhibition, a visitor spends three or four days inside halls, attends one or two sponsored receptions, and leaves with a badge and a stack of brochures.

A Golden Pass concept restructures that journey. The idea is simple: if a major exhibition is based in Aqaba, the pass itself can integrate Petra and Wadi Rum within the same commercial product.

Base delegate pass

- Access to exhibition halls, conference sessions, and networking lounges in Aqaba.

- Standard hosted-buyer or delegate services.

Golden Pass

- All base delegate benefits.

- A full Petra day with timed entry and heritage-sensitive routes, designed to balance cultural respect with business networking.

- An afternoon or evening in Wadi Rum with a structured program such as a short desert drive, sunset experience, and corporate reception or industry gala under the stars.

- Integrated logistics and safety planning, including transfers, guides, and medical support.

Premium hosted-buyer pass

- Extended stay around the core exhibition dates.

- Targeted site visits to free zones, ports, industrial facilities, technology centres, or distribution hubs.

- Private negotiation rooms and curated bilateral or multilateral meetings in Petra or Wadi Rum, depending on group size and protocol.

For FMCG exhibitions, the Golden Pass can connect product and packaging showcases in Aqaba with supply chain visits and brand storytelling sessions in Petra and Wadi Rum. For fintech summits, it can link regulatory panels and infrastructure showcases in Aqaba with closed-door discussions on digital identity, cross-border payments, and financial inclusion framed by heritage and desert settings.

Corporate MICE contracts and retreat programs

A significant share of global MICE demand comes from internal corporate events. These include sales kick offs, partner gatherings, leadership summits, and reward trips. The Aqaba–Petra–Wadi Rum triangle fits these formats in a modular way.

Example program for a regional sales kick off

Days 1–2: Aqaba

- Plenary meetings and product launches.

- Internal exhibition area with booth productions for new tools and services.

- Breakouts by territory or function.

- Evening receptions by the Red Sea.

Day 3: Petra

Strategy workshop built around long term vision, risk, and organisational identity.

Structured visit to Petra with clear timing and group management.

Optional executive dinner and content capture.

Days 4–5: Wadi Rum

- Off-site sessions on culture, collaboration, and performance.

- Team activities that can be scaled up or down depending on risk and brand guidelines.

- Gala dinner and recognition night under the stars.

The same logic applies to corporate retreat programs for senior leadership, technology teams, or partner ecosystems. The objective is not to add random “activities”, but to design a sequence where each environment supports a specific type of conversation and relationship.

Turning exhibitions into sector development platforms

To move beyond basic venue rental, Jordan’s MICE offering needs to prove that exhibitions and summits actually advance sectors, not just host them.

A serious sector development approach would measure every major event against four pillars.

1. Deal flow

- Hosted-buyer programs tied to defined budgets and categories.

- Pre-matched meetings between buyers, suppliers, and regulators.

- Aggregated reporting on potential deal values discussed during the event.

2. Knowledge transfer

- Applied labs where operators, regulators, and solution providers design pilots or frameworks together.

- Side visits to ports, logistics terminals, factories, hospitals, or fintech innovation units.

3. Local supply chain onboarding

- A requirement that international exhibitors meet a fixed number of local SMEs.

- Structured breakout tracks for local suppliers who can plug into regional and international value chains.

4. Long term programs

- Each flagship event anchors a 12 to 24 month initiative such as a pilot portfolio, accelerator cohort, or joint study.

- Progress is reviewed and published at the next edition.

Aqaba’s role as a trade and logistics hub provides a natural base for this kind of corridor thinking. jsf.org+2adc.jo+2 Petra and Wadi Rum create credible settings for strategic, reputational, and cultural elements that are essential when large contracts and multi-country cooperation are on the table. Ammon News+1.

Large scale innovation concepts for MICE in Jordan

Jordan can use the Aqaba–Petra–Wadi Rum triangle as a testbed for new MICE formats that can later be exported to other destinations in the Middle East.

Golden Triangle Trade Week

A multi-sector week that combines:

- Trade and investment exhibitions in Aqaba for logistics, energy, FMCG, fintech, and tourism.

- A Petra leadership summit on regional trade architecture, regulation, and infrastructure.

- A Wadi Rum closing program focused on relationship building and recognition.

Each participating sector would commit to a published action plan, with progress reported the following year. Over time, the week would position Jordan as a regular platform for Eastern Mediterranean and Red Sea trade dialogue. jsf.org+1

Corridor programs embedded in exhibitions

Every major exhibition in Aqaba can include corridor programs such as:

- A logistics corridor with port and free zone visits and resilience workshops in Wadi Rum.

- An FMCG corridor with co-packer visits, packaging labs, and brand localisation sessions in Petra.

- A fintech corridor with meetings at central banks or regulators, sandboxes, and structured corporate retreat content.

These corridors would have clear pricing, KPIs, and sponsor value, and would move exhibitions closer to long term sector initiatives.

Jordan MICE Innovation Lab

A standing lab could:

- Collect challenge statements from sectors featured in exhibitions and summits.

- Run three to six month innovation sprints with startups, established firms, and public bodies.

- Use Petra and Wadi Rum to host final demonstrations, negotiations, and announcements.

This aligns with global trends where MICE is tied to innovation, sustainability, and long term partnerships, rather than one-off gatherings. nextmsc.com+2Grand View Research+2

Concerts, festivals, and the experience layer

Concerts and festivals in the Middle East have already shown that travellers will move across borders for tightly curated cultural and music experiences. Jordan’s heritage sites and landscapes have hosted events such as Medaina, which used Petra, Wadi Rum, Amman, and Aqaba as an integrated stage. Wallpaper*+1

This same creative and technical capacity can be used to raise the standard of:

- Corporate gala dinners.

- Closing concerts linked to trade weeks.

- Curated cultural nights for senior decision makers.

- Stage and light design for large plenaries.

The aim is to keep the artistic and experiential layer connected to business, instead of treating festivals and corporate events as separate worlds.

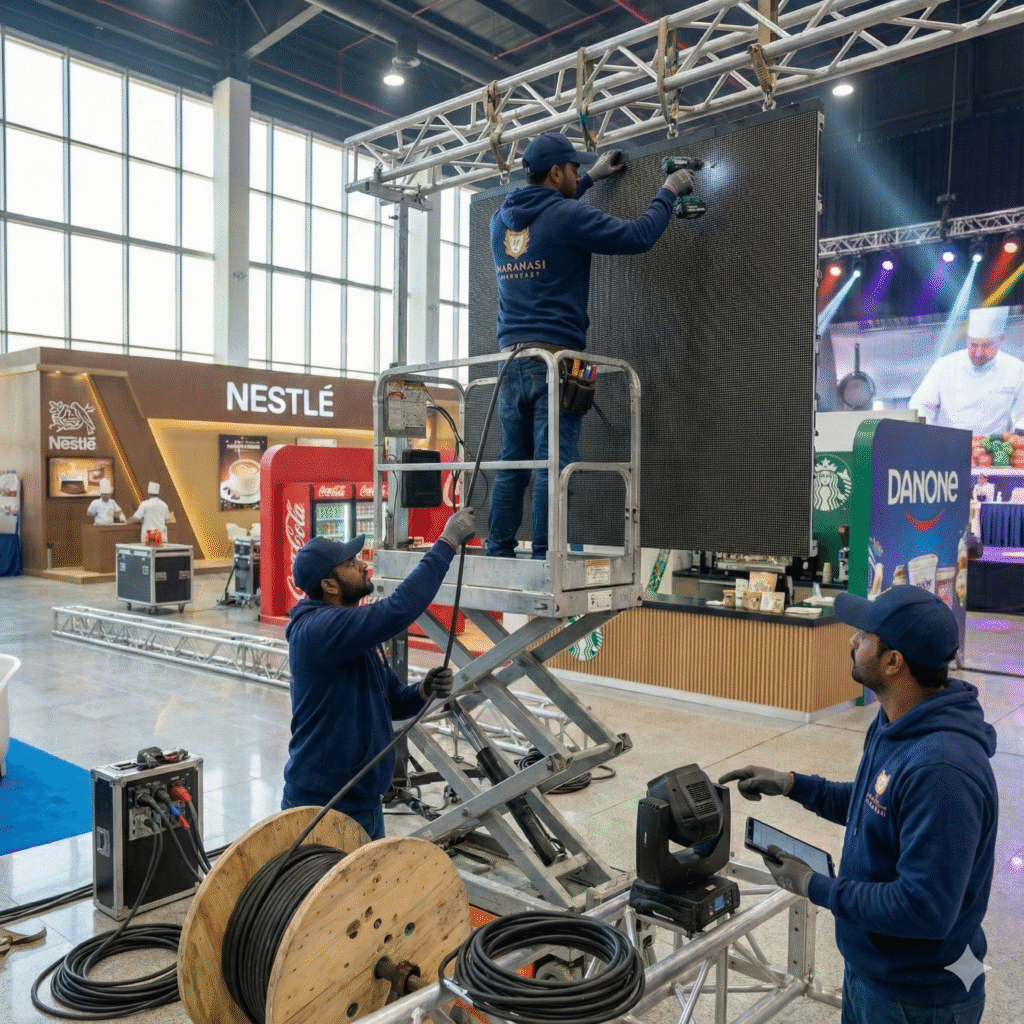

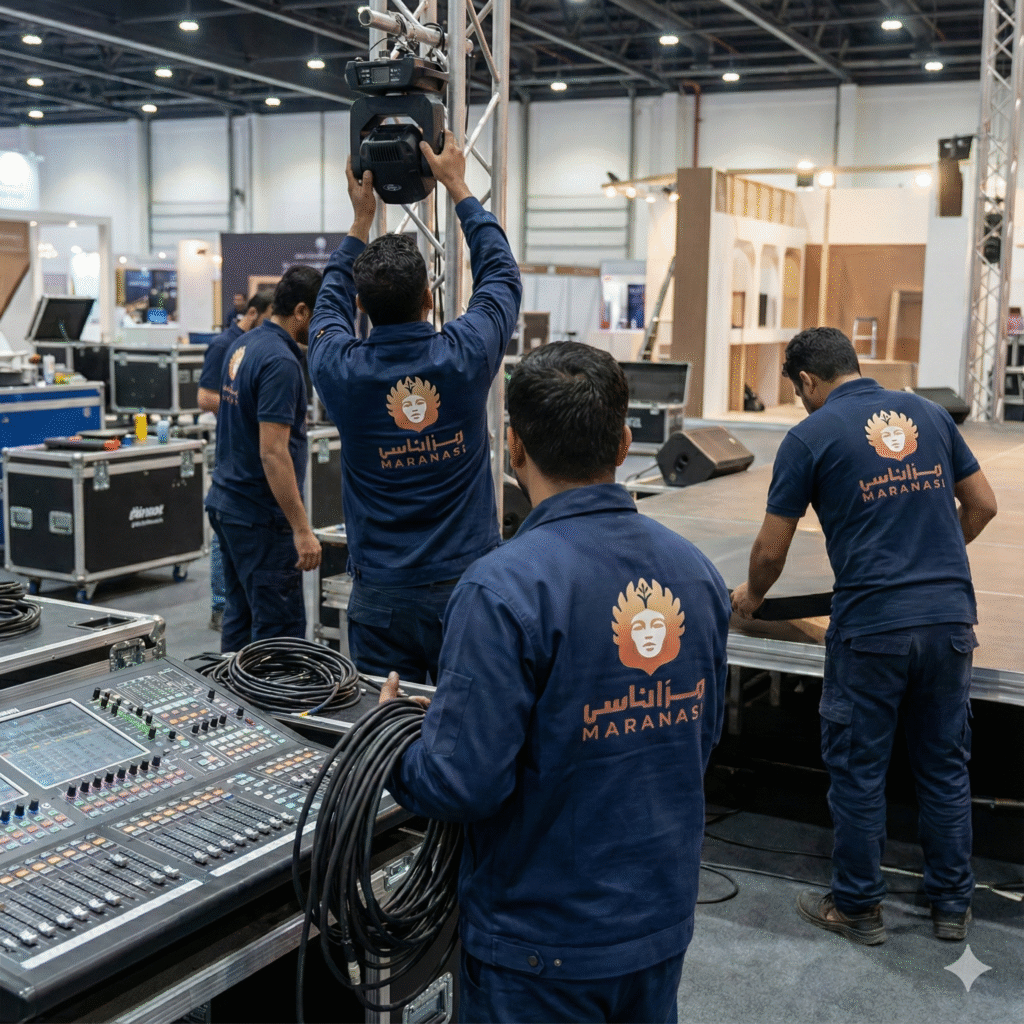

Operators and execution

Concepts alone do not move markets. Execution does.

The Aqaba–Petra–Wadi Rum triangle requires operators who understand:

- Corporate exhibitions and booth productions at international brand standards.

- The structure and logic of MICE contracts, including multi-year frameworks.

- Heritage and environmental constraints in Petra and Wadi Rum, and how to work within them.

- The role of content, film, and documentation in amplifying an event long after it ends.

Jordanian event and production agencies such as MaraNasi operate at this intersection, combining luxury events, destination weddings, exhibitions, corporate gala dinners, conferences, and cinematic content across Jordan and the wider region.

As MICE events demand grows in the Middle East, Aqaba | Petra | Wadi Rum can operate as a regional platform where exhibitions, corporate retreats, FMCG and fintech summits, concerts, and festivals sit inside one coherent ecosystem instead of being treated as separate products.